All Categories

Featured

Table of Contents

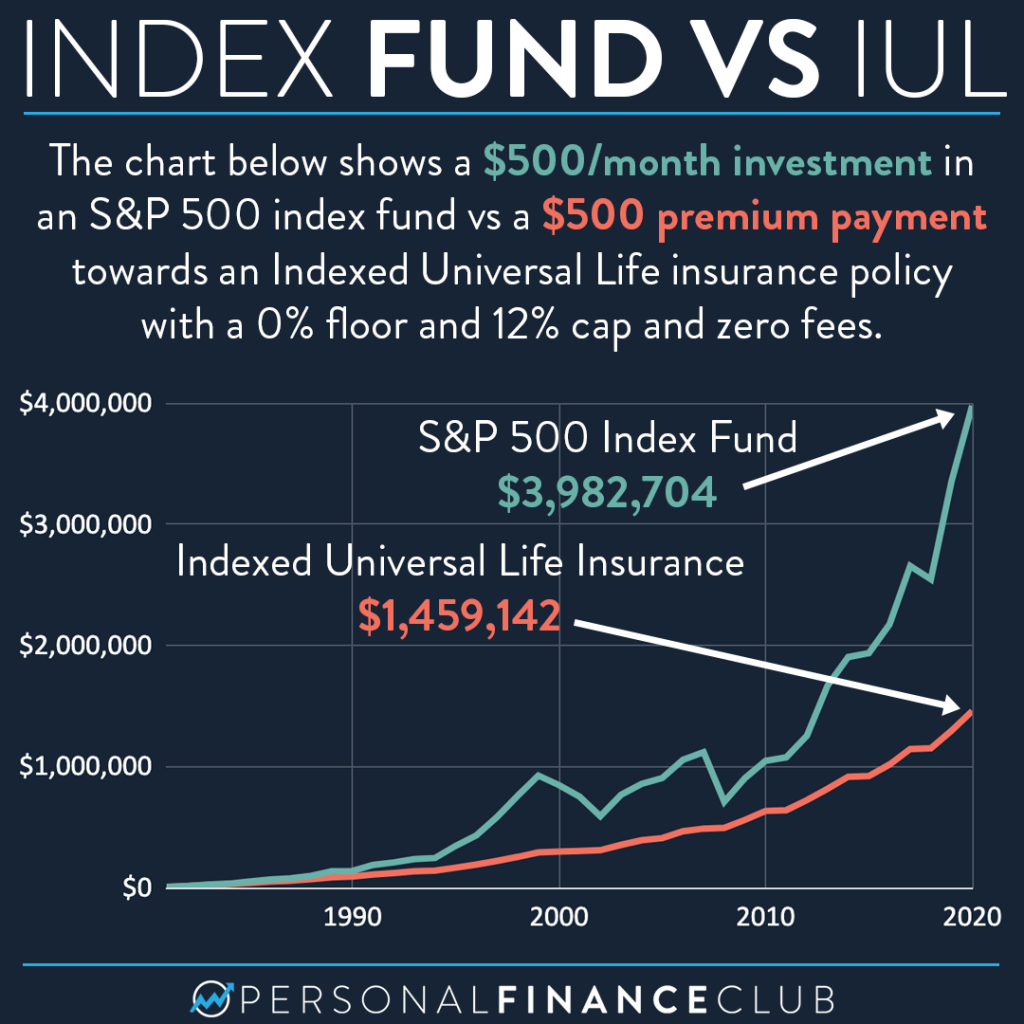

Do they contrast the IUL to something like the Lead Overall Stock Market Fund Admiral Shares with no load, an expenditure ratio (ER) of 5 basis points, a turn over proportion of 4.3%, and an exceptional tax-efficient document of distributions? No, they compare it to some horrible proactively handled fund with an 8% tons, a 2% ER, an 80% turn over ratio, and an awful document of temporary capital gain distributions.

Common funds usually make yearly taxable circulations to fund proprietors, also when the worth of their fund has actually dropped in worth. Mutual funds not just require earnings reporting (and the resulting yearly taxation) when the common fund is going up in value, however can likewise impose earnings taxes in a year when the fund has actually decreased in value.

You can tax-manage the fund, collecting losses and gains in order to minimize taxable distributions to the capitalists, however that isn't somehow going to change the reported return of the fund. The possession of shared funds may need the shared fund owner to pay approximated tax obligations (iul life insurance reviews).

IULs are easy to place to make sure that, at the proprietor's fatality, the recipient is not subject to either earnings or inheritance tax. The same tax obligation decrease methods do not function nearly also with common funds. There are countless, frequently costly, tax obligation catches connected with the moment trading of common fund shares, catches that do not relate to indexed life insurance policy.

Chances aren't extremely high that you're going to go through the AMT because of your shared fund circulations if you aren't without them. The remainder of this one is half-truths at ideal. While it is real that there is no income tax due to your heirs when they inherit the proceeds of your IUL plan, it is additionally true that there is no earnings tax obligation due to your successors when they acquire a mutual fund in a taxable account from you.

Universal Guaranty Investment Company

There are far better methods to avoid estate tax concerns than acquiring investments with reduced returns. Shared funds may create revenue tax of Social Safety advantages.

The development within the IUL is tax-deferred and may be taken as free of tax earnings using loans. The plan owner (vs. the common fund manager) is in control of his/her reportable earnings, hence allowing them to lower and even get rid of the tax of their Social Protection benefits. This one is terrific.

Below's an additional minimal concern. It holds true if you buy a shared fund for state $10 per share right before the circulation day, and it disperses a $0.50 distribution, you are after that mosting likely to owe tax obligations (possibly 7-10 cents per share) regardless of the truth that you have not yet had any kind of gains.

In the end, it's truly regarding the after-tax return, not exactly how much you pay in taxes. You're likewise probably going to have more cash after paying those tax obligations. The record-keeping demands for owning mutual funds are dramatically much more intricate.

With an IUL, one's records are maintained by the insurer, duplicates of annual declarations are sent by mail to the owner, and distributions (if any) are amounted to and reported at year end. This one is likewise kind of silly. Obviously you need to keep your tax documents in instance of an audit.

Universal Life Cash Value Calculator

Rarely a reason to buy life insurance coverage. Common funds are typically part of a decedent's probated estate.

Furthermore, they undergo the delays and expenditures of probate. The earnings of the IUL policy, on the various other hand, is always a non-probate circulation that passes beyond probate straight to one's named beneficiaries, and is consequently not subject to one's posthumous creditors, undesirable public disclosure, or similar hold-ups and expenses.

We covered this under # 7, but just to summarize, if you have a taxable common fund account, you have to place it in a revocable depend on (or perhaps less complicated, make use of the Transfer on Death designation) to avoid probate. Medicaid incompetency and life time revenue. An IUL can offer their proprietors with a stream of revenue for their whole life time, despite how much time they live.

This is beneficial when organizing one's affairs, and transforming possessions to earnings before a nursing home confinement. Mutual funds can not be transformed in a comparable manner, and are usually considered countable Medicaid possessions. This is another dumb one promoting that poor individuals (you know, the ones who require Medicaid, a federal government program for the poor, to spend for their retirement home) ought to utilize IUL rather than mutual funds.

Equity Index Insurance

And life insurance policy looks horrible when compared relatively against a retired life account. Second, individuals that have money to purchase IUL over and past their pension are mosting likely to have to be terrible at taking care of cash in order to ever before get Medicaid to pay for their assisted living facility expenses.

Chronic and terminal ailment cyclist. All policies will allow a proprietor's easy access to money from their plan, commonly forgoing any abandonment charges when such people suffer a severe disease, require at-home care, or become constrained to a retirement home. Mutual funds do not provide a similar waiver when contingent deferred sales fees still relate to a mutual fund account whose owner needs to offer some shares to fund the costs of such a remain.

Iul Insurance Quotes

You obtain to pay more for that benefit (biker) with an insurance coverage policy. What a wonderful offer! Indexed universal life insurance policy supplies survivor benefit to the recipients of the IUL owners, and neither the proprietor neither the recipient can ever before shed cash as a result of a down market. Common funds give no such warranties or fatality benefits of any kind of kind.

Now, ask on your own, do you in fact require or desire a fatality advantage? I certainly don't need one after I reach monetary self-reliance. Do I desire one? I suppose if it were low-cost enough. Certainly, it isn't inexpensive. On average, a purchaser of life insurance spends for the true expense of the life insurance policy advantage, plus the prices of the policy, plus the profits of the insurance firm.

Disadvantages Of Indexed Universal Life Insurance

I'm not entirely sure why Mr. Morais threw in the whole "you can't lose cash" once more here as it was covered quite well in # 1. He just intended to duplicate the ideal marketing factor for these things I suppose. Once more, you don't shed small dollars, yet you can shed actual bucks, along with face major possibility price as a result of low returns.

An indexed universal life insurance policy plan owner might exchange their plan for a completely different plan without triggering income taxes. A common fund owner can stagnate funds from one common fund company to one more without selling his shares at the previous (hence triggering a taxed occasion), and buying brand-new shares at the latter, typically subject to sales charges at both.

While it is true that you can trade one insurance policy for one more, the factor that people do this is that the initial one is such a terrible plan that also after acquiring a brand-new one and going through the early, adverse return years, you'll still appear ahead. If they were offered the right policy the initial time, they should not have any kind of need to ever exchange it and go via the very early, negative return years once more.

Latest Posts

Insurance Indexing

Universal Life Quotes Online

Universal Life Quotes